A dozen deal closings to close the year 2025!

1. Liveware Group acquires AI-first software development agency, 4mation Technologies

Sydney-headquartered business growth and tech consultancy Liveware Group has acquired 4mation Technologies, an Australia AI-first software development agency. Founded in Sydney in 2001, 4mation Technologies specialises in modernising legacy systems, building secure applications and delivering AI-driven solutions. The company counts Lendlease, Merivale, Atlassian, HCF and the NSW government among its customers. For 4mation’s clients, the acquisition “ensures continuity” with the 4mation brand while unlocking access to Liveware’s international delivery centres in Sydney, Manila, and Bucharest, as well as its specialist consulting teams. It will also bring together integrated expertise across AI, software engineering, business strategy, and process.

2. AtkinsRéalis Group Inc., announced today that it has acquired ADG Capital Pty Ltd

AtkinsRéalis Group Inc., a world-class engineering services and nuclear company with offices around the world, announced today that it has acquired ADG Capital Pty Ltd (“ADG”), an Australian engineering consultancy specializing in structural and civil engineering, construction services, and digital advisory. This acquisition is a step towards AtkinsRéalis’ ambition to build a larger scale presence in the Australian market. The addition of ADG’s approximately 250 professionals to AtkinsRéalis’ existing team creates an enhanced resource pool to capitalize on Australia’s significant investment programs in infrastructure and other high growth customer end-markets, such as Defence and Power & Renewables in which AtkinsRéalis has recognized capabilities. Founded in 2002, ADG has a strong track record of long-term growth and a reputation for technical innovation, and is known for successfully delivering complex projects for its clients. The combination of ADG’s entrepreneurial spirit and local presence with AtkinsRéalis’ global scale creates a strong set of customer solution offerings in this key growth market.

3. Labflow is pleased to announce that they will be joining Magentus

Labflow is pleased to announce that they will be joining Magentus, a recognised leader in healthcare information technology. This milestone represents an important next step in their mission to transform pathology through intelligent, connected and scalable digital solutions. Labflow will continue to operate as a standalone technology company, retaining our existing team, leadership and brand. With the backing of Magentus’s global scale and deep healthcare expertise, we are strengthening our ability to deliver innovative, customer-focused solutions at pace.

4. X provider Symbos acquires contact centre group CPM Australia

Melbourne-based customer experience (CX) and digital services provider Symbos will bolt on contact centre expertise with the acquisition of CPM Australia for an undisclosed sum, in a deal that increases its total staff numbers by 300 to more than 2,000 people. The move is expected to enhance the capability of Allegro Funds-backed Symbos, leveraging its digital infrastructure with CPM’s established contact-centre expertise to provide an AI-enabled service capability and global delivery network across Australia, New Zealand, Fiji, the Philippines and South Africa. Symbos CEO Avik Choudhuri says the acquisition accelerates the organisation’s strategic vision of becoming a true end-to-end CX disruptor in the Australian market.

5. SGS Expands Agricultural Quality Assurance with Acquisition of Australian Superintendence Company

SGS, the world’s leading testing, inspection and certification company, has acquired Australian Superintendence Company (ASC), a leading specialist in agricultural quality assurance in Australia. The acquisition brings 40 specialist experts to the Group and supports “Strategy 27 – Accelerating growth, building trust” by expanding services that safeguard people’s health, safety and wellbeing. Established in 1969, ASC has built a strong reputation for inspection and laboratory services for Australian export grains, legumes, pulses and oilseed. The company has also contributed to international standards development for sampling and analyses of grains and oilseeds through its involvement with the International Standardization Organization (ISO), the Grain and Feed Trade Association (GAFTA), and the Federation of Oils, Seeds and Fats Associations (FOSFA).

6. EQT to invest in PropertyMe, a leading Australian cloud-based PropTech company

EQT is pleased to announce that the BPEA Mid-Market Growth Partnership (or “the MMG fund”) has agreed to invest in PropertyMe (the “Company”), a leading cloud-based PropTech company in Australia and New Zealand. The transaction will see EQT become the majority investor in PropertyMe, partnering with the Company’s founders who will retain a significant minority stake. Founded in 2013 and headquartered in Sydney, PropertyMe offers an all-in-one, cloud-based platform that helps property managers and real estate agencies streamline their workflows, from trust accounting and compliance to maintenance tracking and tenant communications. PropertyMe’s platform is used by more than 6,000 agencies to manage approximately 1.9 million rental properties, making it the largest property management software provider in Australia and New Zealand by number of properties managed. Agencies collectively transact almost $40 billion through PropertyMe each year, including $2.4 billion directly through PropertyMe’s own MePay payments platform.

7. Havas Accelerates Growth in ANZ with Acquisition of Independent Media Agency Kaimera

Havas Accelerates Growth in ANZ with Acquisition of Independent Media Agency Kaimera Strategic Addition Expands Havas Media Network’s Scale and Capabilities, Reinforces Converged.AI Strategy, and Unlocks New Opportunities for Clients Left to Right: James Wright, Group CEO Havas ANZ & Global Chair, Havas PR Network; Nick Behr, CEO and Founder, Kaimera; and, Trent McMillan, Chief Digital and Product Officer and Founder, Kaimera Havas announces the acquisition of Kaimera, an award-winning, independent media agency recognized for its expertise in simplifying media complexities and delivering tailored, impactful solutions. This strategic move strengthens Havas Media Network’s footprint in Australia and New Zealand, adding scale and specialist capabilities while accelerating the deployment of Converged.AI, Havas’ group-wide AI-driven, datapowered strategy and operating system. Kaimera will join the organization under Havas Media Network and operate as “Kaimera, a Havas Company.” Founded in 2016, Kaimera has grown into a 50+ strong agency with offices in Sydney and Melbourne and team members in Auckland. Known for crafting straightforward, customized solutions that deliver measurable results, Kaimera brings deep expertise and a strong reputation that will reinforce Havas’ dynamic and ambitious ANZ business plan focused on growth, entrepreneurial investment, and excellence for clients. Kaimera’s clients include Nando’s, Scape, IMB bank, Afterpay and BritBox. By integrating Kaimera’s proven expertise and entrepreneurial culture into Havas Media Network, this acquisition enhances Havas’ ability to converge creativity, media, and technology into one powerful offering.

8. Banyan Software is pleased to announce that Harrier-National (Sales) Pty. Limited has joined its group of software companies

Banyan Software is pleased to announce that Harrier-National (Sales) Pty. Limited (“Harrier”) has joined its group of software companies. This partnership reflects a shared commitment to long-term growth, strong customer relationships, and delivering dependable software solutions that support essential business operations. Founded in 1985 and based in Sydney, Australia, Harrier provides software for warranty, roadside assistance, and customer retention to automotive dealerships. Its flagship cloud-based platform, Ignition, helps dealers manage used-car warranties, bundle roadside assistance, automate service-linked communication, and track performance with real-time analytics.

9. RSK Group acquisition adds Civil Geotechnical Consultants to Australia division

CGC has offices in Brisbane, Cairns, the Gold Coast, Melbourne, the Sunshine Coast and Townsville. The engineering team of 35 offers a range of services, including site investigations, design and analysis, construction services, advisory services, aerial mapping and asset management. Clients include local and state government (Queensland and New South Wales) and businesses such as Fulton Hogan, McIlwain, JF Hull, John Holland, Laing O’Rourke, Georgiou, ACCIONA, SEE Group and CMC. Recent projects have seen CGC delivering geotechnical consulting services to its clients in the transport infrastructure sector in both road and rail. These services have included investigation, design, construction phase support and tender design services on large nation-building projects, including the Coomera Connector and Direct Sunshine Coast Rail.

10. The Sequana Group has welcomed two new specialist partnerships, with environmental and sustainability consultancy, WolfPeak

The Sequana Group has welcomed two new specialist partnerships, with environmental and sustainability consultancy, WolfPeak, and communications and engagement firm, Factotum Communications, joining the Group. Together, they further strengthen the Sequana Group’s capability across environmental advisory, sustainability, planning, community engagement and integrated project delivery. These additions mark the next step in Sequana’s growth, following the successful partnerships with Atlas Engineering Group and IPS (Infrastructure Project Solutions) in June 2025, and the 2024 strategic investment in Sequana by Pemba Capital Partners. The expanded Group now offers one of Australia’s most comprehensive end-to-end project delivery platforms across the water, environment and energy sectors.

11. IMG to buy Tyco NZ and Red Wolf

Intelligent Monitoring Group (IMG) has entered into a binding agreement to acquire all the shares in BlueSky Holdco Limited (Tyco NZ and Red Wolf) from Johnson Control Luxembourg European Finance S.a.r.l (a subsidiary of Johnson Controls International plc) for NZ$45 million (A$40 million). Tyco NZ is a fire protection service company and Red Wolf is a high-level security provider, with both businesses providing ongoing service, maintenance and installations for commercial customers across New Zealand under the Wormald and Red Wolf brands. Tyco NZ boasts nationwide coverage through 12 branches and over 300 staff, while Red Wolf has a “strong presence” in the Wellington Government, council and commercial markets, complementing IMG’s existing ADT NZ footprint (which is strongest outside Wellington). Tyco NZ’s operations are backed by recurring service contracts, which make up 75% of its annual revenue, with a diversified customer base across commercial, industrial, healthcare, education, marine, aviation and critical infrastructure and “strong regulatory tailwinds driving essential, non-discretionary demand”. RedWolf adds a standalone commercial security provider, supported by security-cleared staff and ISO-aligned processes, certified across major global security platforms and in possession of a “high-recurring-revenue base driven by monitoring, maintenance and asset-management contracts”.

12. Brennan set to supercharge next growth phase following an investment by Macquarie Capital Principal Finance

Leading Australian systems integrator, Brennan, is set to supercharge its next phase of growth through acquisition and organic expansion following an investment by Macquarie Group’s principal investment arm, Macquarie Capital Principal Finance. Macquarie’s investment represents a significant milestone for Brennan, a business that has grown its revenue at an average of 21.5 per cent per annum over its 28 years of operations and with over 1,000 team members. Through its customer connected approach, Brennan has achieved an industry leading Net Promoter Score of more than 80 and a retention rate of more than 95 per cent. Founder and Managing Director of Brennan, Dave Stevens, who remains at the helm of the business and the majority shareholder, said the investment marked a major milestone in the evolution of Brennan and would reinforce its position as Australia’s largest sovereign systems integrator.

Strong start to the year for the M&A market in B2B Services

Strong M&A Momentum in November as B2B and IT Services Head Toward a Strong Finish to 2025

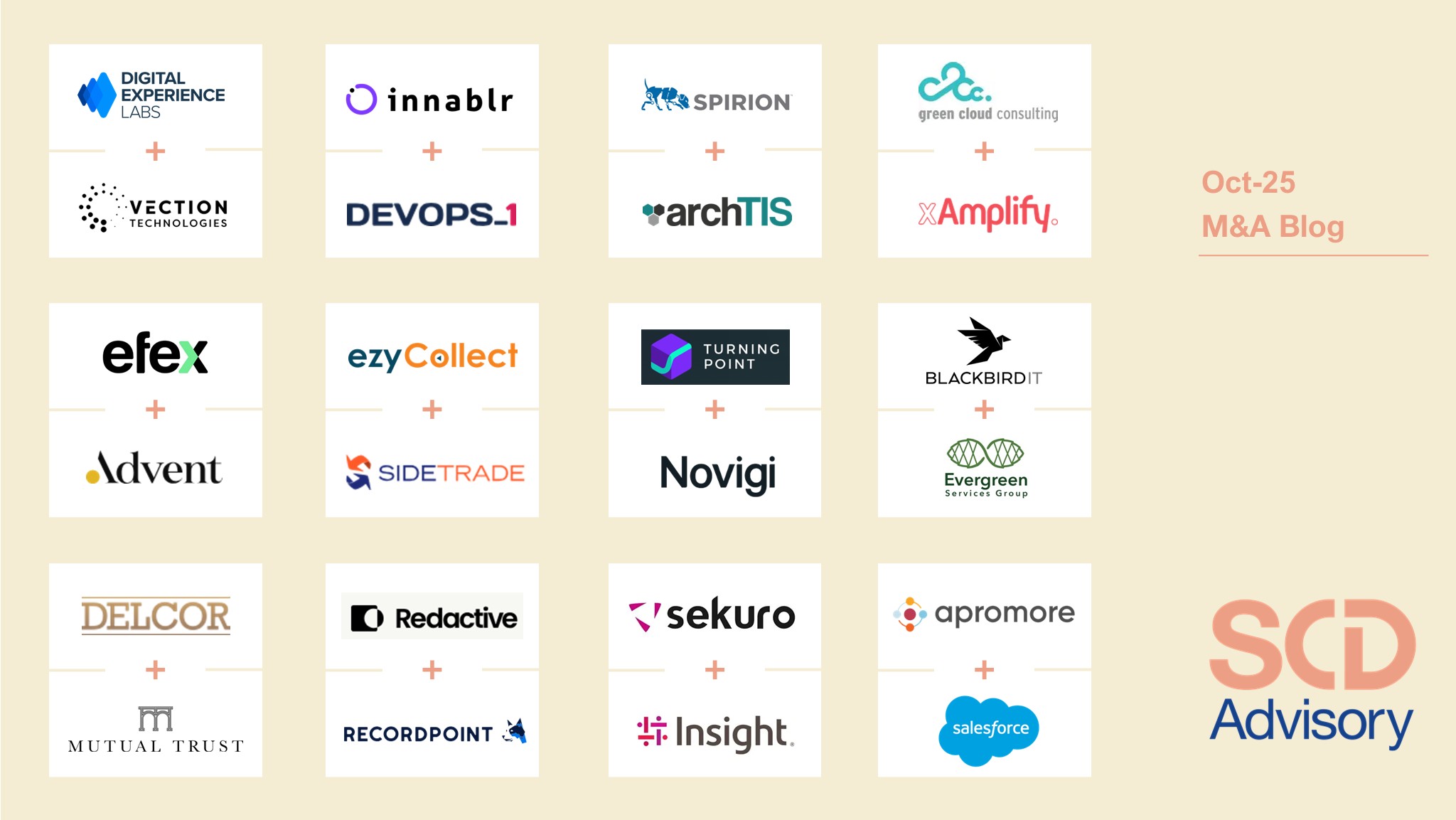

M&A blog Oct: Intense M&A activity in BtoB Services, with IT Services leading the trend

Give us a call on +61 434 730 099. Or, email us at info@scdadvisory.com

or fill in our contact form and we will give you a call.