First M&A blog of FY26, confirming interest in the B2B Services sector

1. Banyan Software welcomes Tapaas Pty Limited into its Family of Software Businesses

Banyan Software, a company that acquires and supports mission-critical software businesses for the long term, is pleased to announce the acquisition of Tapaas Pty Limited (“Tapaas”), the premier provider of real-time, cloud-based risk management solutions for retail FX and CFD brokers. Founded in 2014 and based in Sydney, Australia, Tapaas was created to enable brokers to control and leverage risk in the fast-moving and ever-evolving retail trading markets. Its platform offers a comprehensive suite of real-time risk management capabilities including exposure monitoring, trader surveillance, anomaly detection, liquidity analysis and complex actionable

2. Simplyai acquires data discovery firm Optivia

Australia’s automation AI, data, and agentic AI consulting firm Simplyai has acquired Optivia. Based out of Melbourne, Optivia provides data discovery and preparation, data quality and governance, analytics and business intelligence solutions. Simplyai said the acquisition was “a strategic move … further enhancing capabilities to better serve clients in an increasingly complex data and Agentic AI environment.” Simplyai MD Jason Catania said the company plans to continue to build and develop the Simplyai team and are excited for the growth opportunities that this new investment partnership will provide for Simplyai. Optivia MD Phil Ball said joining forces with Simplyai presents an exciting opportunity for the team and clients alike.

3. Teneo makes major Aussie push through purchase of PwC’s restructuring arm

Global consultancy Teneo has purchased PwC’s Australian restructuring arm, in the process launching its financial advisory business downunder with over 80 professionals already in place. In a major disruption to the Australian consulting sector, Teneo properly enters the local scene with more than a dozen former PwC partners and 70 staff, significantly adding to its current local headcount of around 15 strategy & communications professionals. The acquisition confirms earlier reports of PwC’s intended sell-off, and follows the firm’s divestment from its Indigenous Consulting business and the shedding of its $650 million public sector practice in the immediate aftermath of the government tax breach scandal. As part of its bold move on the Australian market, the New York-headquartered firm, which is majority-owned by CVC Capital Partners, will establish a new office in Brisbane in the coming weeks, as well as significantly expand its existing operations in Sydney and Melbourne. Teneo made its first real push into Australia in 2018, backed by its subsequent acquisition of Sydney-based strategic communications consultancy Quay Advisors, but hasn’t had a huge impact on the local market since then, despite counting former Dow Chemical CEO and Brisbane Olympics organising committee president Andrew Liveris as a senior advisor.

4. Urbis acquires niche urban planning consultancy Echelon Planning

Building on a relationship spanning over 20 years, Echelon Planning has integrated into the consulting practice Urbis. Founded in 2012, Echelon Planning is a niche urban planning consultancy based in Brunswick, Victoria. The consulting firm works with state and local governments, property developers, landowners and companies looking to undertake planning and development projects of various types. As part of a 900-strong multidisciplinary consulting practice, this acquisition grows the national planning practice of Urbis to over 350 consultants, making it one of the largest of its kind in Australia. The move will see the two co-founders of Echelon Planning, Mark Woodland and Sarah McQuillen, join Urbis as a director. They both have over 20 years of experience working on large scale planning and urban renewal projects, and preparing strategic plans and studies for major development sites.

5. Cutcher & Neale expands into Melbourne with addition of BBB Partners

Cutcher & Neale, a 250-person accounting and advisory firm, has acquired BBB Partners, a Melboune-based counterpart with around 50 staff. Announced yesterday, the deal marks Cutcher & Neale’s expansion into Melbourne, which will be the firm’s fourth location, alongside offices in Newcastle, Sydney and Brisbane. Founded in 1953, Cutcher & Neale is an accounting and advisory firm that serves businesses and individuals. The company offers a full range of services including business advisory, taxation, audit, retirement, and financial planning. BBB Partners meanwhile is known for its accounting, financial planning, succession planning, and wealth management services. The firm is particularly active in the medical and healthcare sector. With the addition of BBB Partners, Cutcher & Neale is on track to enter the list of Australia’s 30 largest accounting firms. As part of the deal, the firm’s annual revenue is expected to increase to $46 million in 2025.

6. Phenna Group acquires Asset Management Engineers

Headquartered in Nottingham, UK, Phenna Group’s aim is to invest in and partner with selected niche, independent Testing, Inspection, Certification and Compliance (TICC) companies that serve a variety of sectors, ensuring customers’ peace of mind by delivering first class testing and assurance services. Asset Management Engineers (AME) is our 10th deal in 2025 and our 16th business in the APAC region, augmenting our existing service offerings. AME is a leader in plant testing, inspection and certification. Based in Perth and providing services throughout Australia, AME assists their customers in the resources, energy and industrial industries to reduce risk, meet regulations and enhance the lifecycle of their key assets.

7. Bailey Abbott acquires Perth-based data consultancy Lime Theory

South Australian digital advisory Bailey Abbott has further cemented its Western Australian expansion through the acquisition of Perth-based business intelligence firm Lime Theory. Established by director Matt Neil in Perth in 2019, Lime Theory’s team of around ten professionals serve local clients on data strategy, analysis, and management solutions, with a focus on Microsoft’s Power BI platform. The purchase follows Bailey Abbott’s recent move into the state after having previously flagged its national intentions, with further expansion to the Northern Territory and Tasmania and additional acquisitions currently on the cards. Neil established Lime Theory after more than half a decade in various roles at BHP and Rio Tinto, before which he spent time at IT consultancy J&M and Deloitte. Nicholas Schafer meanwhile, Lime’s solutions lead who joined the firm from NRI-owned Veralda last year, previously worked with Bailey Abbott’s WA managing partner Glen Appleton at Telstra Purple.

8. HWL Ebsworth acquires Adelaide firm Botten Levinson Lawyers

HWL Ebsworth Lawyers has announced the acquisition of Adelaide-based firm Botten Levinson Lawyers for an undisclosed sum, with plans to welcome the majority of the latter’s staff into the team including four of its six principals- James Levinson, Ali Field, Rosie Jervis and Pip Metljak. The acquiring firm asserts there will be continuity for Botten Levinson Lawyers’ clients, while the deal strengthens the firm’s presence in South Australia where it already has an office in the Adelaide CBD.

9. SoftwareOne completes mega billion-dollar acquisition of Crayon

Operating under the SoftwareOne logo, it will now be one of Microsoft’s largest partners. SoftwareOne has completed its acquisition of Crayon, creating a combined global provider with software and cloud solutions, with a total revenue of CHF 1.6 billion (A$3.075 billion) and 13,000 employees across more than 70 countries. At the time of the initial announcement ARN reported, the combined company expects significant value creation through major revenue and cost synergies. Crayon stated that run-rate cost synergies of CHF 80–100 million ($143–178 million) within 18 months of completion have been identified, in addition to SoftwareOne’s earlier announced cost savings of over CHF 50 million ($89 million). Following a joint evaluation, the unified organisation will operate under the SoftwareOne name and logo, leveraging its global brand recognition while incorporating Crayon’s legacy. Co-CEOs Raphael Erb and Melissa Mulholland will lead the executive board and will be joined by regional presidents, who have also been recently appointed. The integration process will include the implementation of a joint operating model, alignment of the go-to-market strategy and offering, as well as integration of IT systems and consolidation of legal structures in overlapping countries. The combined company will retain its legal headquarters (HQ) in Switzerland, while Crayon’s Oslo HQ will remain an important hub for both sales activities and certain other functions. SoftwareOne said This decision reflects the strategic integration of both companies’ capabilities, values, and market presence.

10.Virtual IT Group and The Instillery announce trans-Tasman merger.

Australian-based Virtual IT Group and New Zealand’s The Instillery have announced they are joining forces to form one of the largest integrated trans-Tasman managed services and security providers in the market. The Instillery had already begun to expand into Australia with leading technology partnerships with Wiz and Zscaler, including collaborating with VITG on joint customers. Both organisations come with a focus on partnering with customers to keep them ahead with their security and technology needs. VITG was founded in 2015 by Christian Pacheco and now employs over 240 staff, while The Instillery employs over 160 staff. The terms of the transaction were not disclosed. However, VITG partnered with global mid-market private equity firm The Riverside Company last June to accelerate growth through a combination of strategic acquisitions and organic expansion. The Instillery had already begun to expand into Australia with its leading technology partnerships, such as with Wiz and Zscaler, and had collaborated with VITG on joint customers. The group was now looking for further opportunities to grow the platform both geographically and with complementary capabilities, Russell said. The businesses would continue to operate with local leadership teams and brands, while integrating and leveraging shared capabilities to provide technological breadth and depth.

11. Professional services company Novon buys Technology People

Sydney-based Novon has acquired technology resourcing firm Technology People, in the process launching Novon on Demand and establishing what it says is one of Australia’s largest privately owned data service providers. The acquisition integrates Technology People’s talent solutions with Novon’s specialist data consulting capabilities, creating a combined team of more than 100 consultants nationwide. Founded in 2014 as Xpert Consulting, Novon provides advisory and professional services focused on data management, governance, engineering, integration, insights, machine learning and artificial intelligence. Technology People was established in 2011 has placed over 2,000 specialist technology resources during 14 years supporting digital transformation programmes for major Australian enterprises. The combined entity intends to serve clients including ASX-listed companies and leading small to medium enterprises across banking, aviation, utilities, logistics, government and media sectors.

12. Viridian Financial Group Welcomes Strategic Growth Investment from TA Associates

Viridian Financial Group (Viridian), today announced that TA Associates (“TA”), a leading global private equity firm, has signed an agreement to make a strategic investment in the business. Since its founding in 2015, Viridian’s grown three specialised business divisions, Viridian Advisory, Infinity Capital Solutions and Smartmove Lending, providing wealth advice, investment solutions and mortgage broking services to over 15,000 clients. By partnering with TA, Viridian will leverage TA’s global resources and extensive experience in the financial services industry to expand its capabilities, enhance its service offerings and fuel client success. The agreement remains subject to customary conditions. Settlement is expected to occur in the third quarter of 2025.

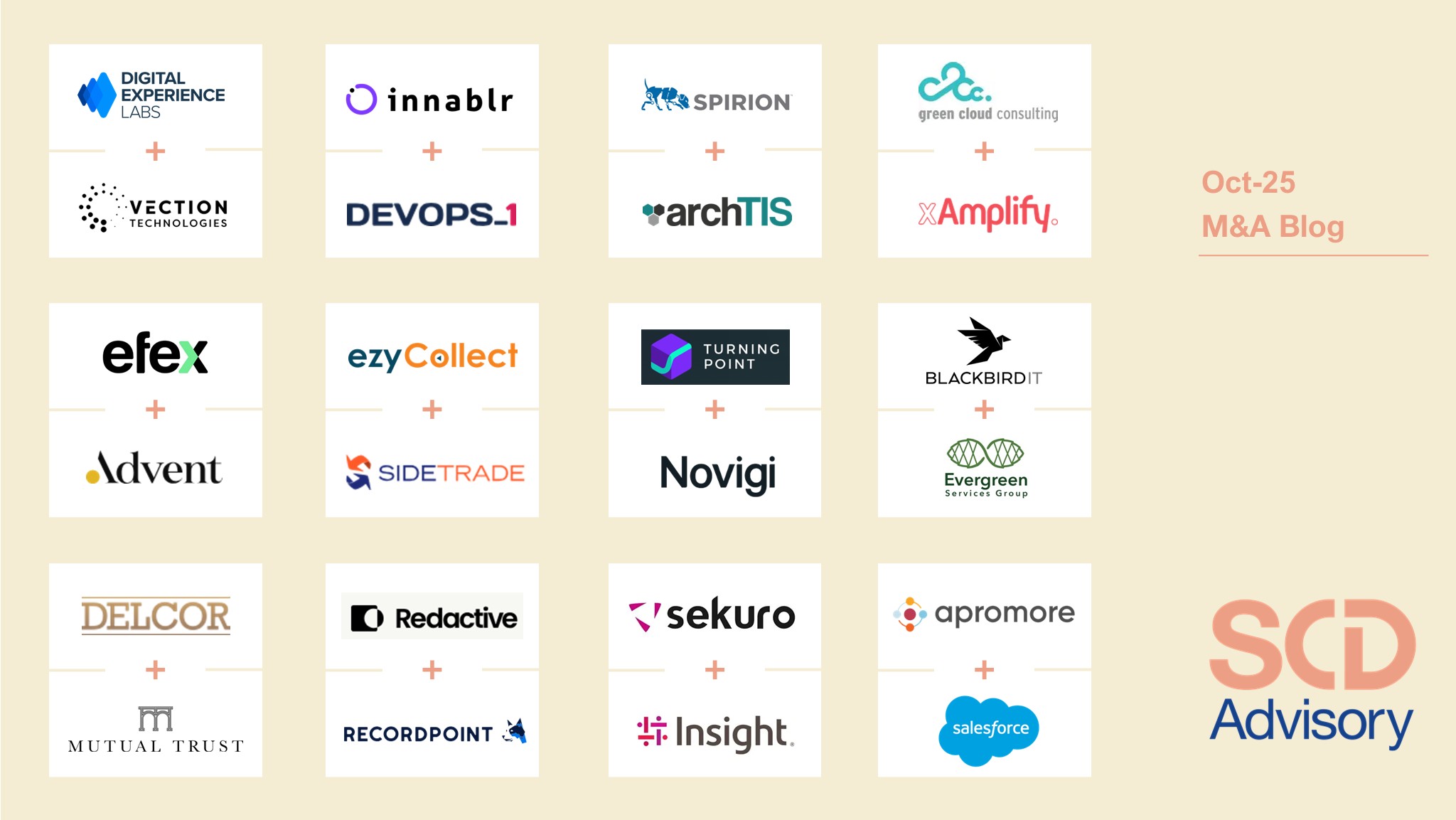

M&A blog Oct: Intense M&A activity in BtoB Services, with IT Services leading the trend

M&A Activity Remains Strong in September Including SCD transaction Libertas/LVP!

18 deals in the month of Aug-25 incl. large ones: CyberCX, Verscent, Nexon, Infomedia

Give us a call on +61 434 730 099. Or, email us at info@scdadvisory.com

or fill in our contact form and we will give you a call.