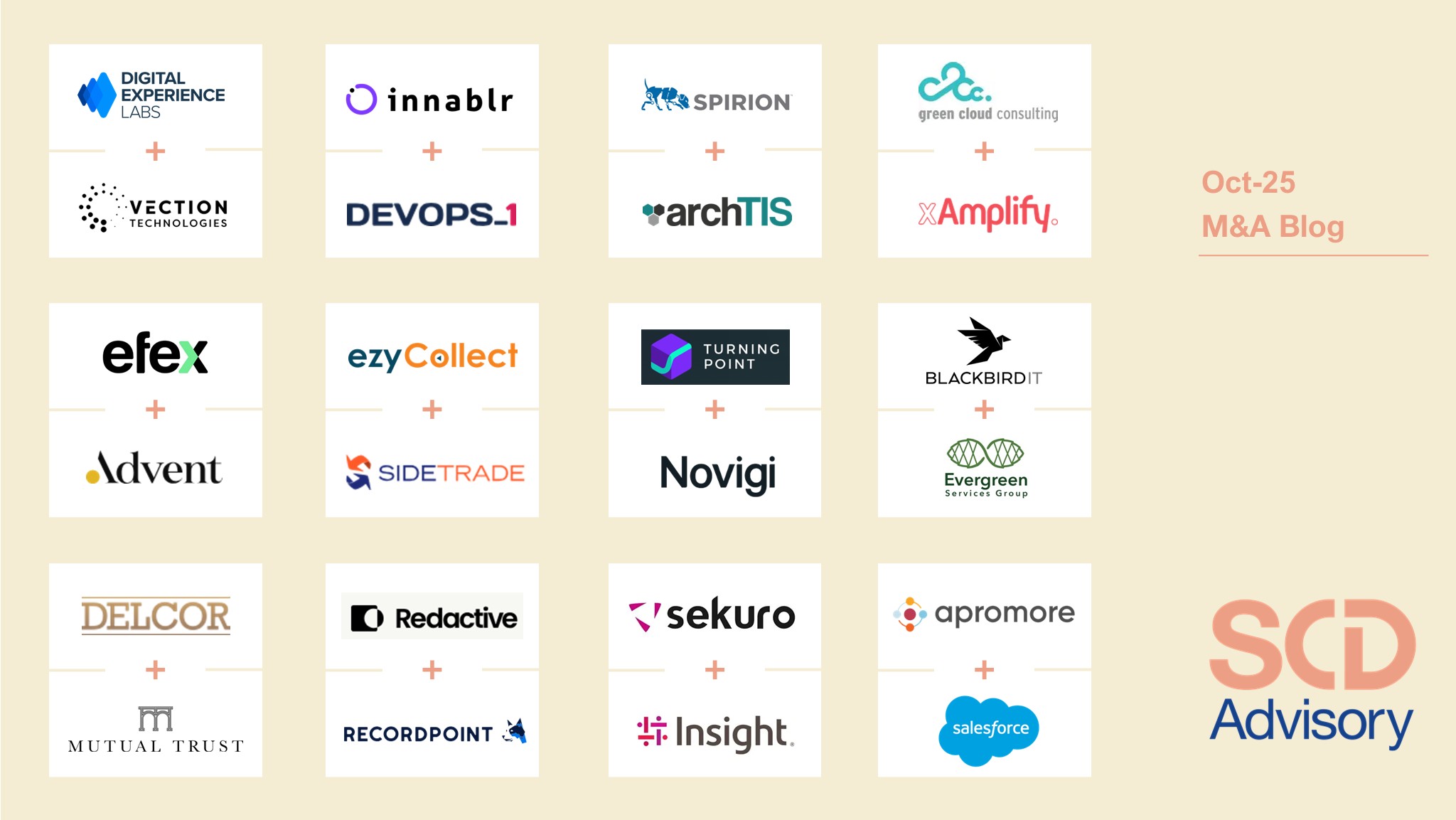

Last M&A monthly blog of the FY25!

1. Macquarie Capital invests in automated systems and AI integrator xAmplify

Automation systems and AI integrator xAmplify has received a “significant equity investment” from Macquarie Capital Principal Finance to accelerate the Canberra-headquartered company’s national expansion, and strengthen its capability to deliver digital transformation services to government and enterprise clients. Founded in 2018, xAmplify has grown rapidly on the strength of its integrated offerings across AI, cybersecurity, managed services, business transformation, and automation. A planned merger with cybersecurity consultancy CSO Group fell through in 2024, but more recently the company acquired ServiceNow partner TCloud, opened a new Sydney office, and is planning further expansion across Australia this year. The company declined to disclose the size of the latest investment, but documents lodged with the corporate regulator indicate Macquarie has more than $4.3 million worth of xAmplify shares. xAmplify claims this figure is incorrect but is yet to provide any further clarification.

2. Canva to buy Sydney-based adtech start-up Magicbrief

Australian AI-powered creative intelligence start-up Magicbrief is set to be acquired by Canva, signalling the visual communications giant’s push into the enterprise and marketing space. Announced at the 2025 Cannes Lions International Festival of Creativity, the acquisition marks a major expansion of Canva’s platform. It will bring data, insights, and design together into one collaborative workflow. Magicbrief’s technology will be brought into Canva to help teams create content that is engaging and on brand, as well as informed and underpinned by real-time performance data. Sydney-based Magicbrief was founded in 2022 by George Howes and Dan Nolan. It is a workflow tool that allows users to uncover top-performing ad creative, understand which creative elements are driving performance, and quickly generate data-backed briefs for future pieces of work.

3. Evergreen snaps up Brisbane-based REDD as its 100th MSP acquisition

US-based Evergreen Services Group has made its 100th managed service provider (MSP) acquisition with the purchase of Brisbane-headquartered REDD. Under the new ownership, REDD will continue to operate independently under the holding group’s MSP portfolio, Lyra Technology Group. Evergreen said in a statement that the deal is a “key investment” in expanding its presence in the Australia and New Zealand (A/NZ) region.

4. CBRE to acquire commercial property brokerage Burgess Rawson

Burgess Rawson, a leading commercial property agency that recently celebrated a half-century in operation, has reached a deal to be acquired by the Australian arm of global, Texas-based property powerhouse CBRE. CBRE revealed today that it had entered into a definitive agreement to buy Burgess Rawson with the transaction – for an undisclosed sum – due for completion next month. The deal does not include Burgess Rawson operations in WA or the ACT which are independently owned. Founded in 1975 by Chris Burgess, Gerald Rawson and Graeme Watson, the privately-owned Burgess Rawson is a market leader in Australia’s private and high-net-worth commercial property investor market, and employs more than 80 people. Managing transactions in a broad range of sectors, including early education, convenience retail, fast food, healthcare, large-format retail and service stations, Burgess Rawson is expected to “significantly strengthen” CBRE’s Metropolitan Investments business.

5. Novigi acquires Iress’ Superannuation Consulting & Managed Services Business

Novigi acquires Iress’ Superannuation Consulting & Managed Services Business from Apex Group. The deal follows Apex Group’s acquisition of Iress’ superannuation business, and will see over 100 specialised consultants transition to Novigi. The acquisition immediately follows Apex Group’s acquisition of the Iress Superannuation business, including the Acurity software suite, and is another significant step forward in the close collaboration between Novigi and Apex. As part of the transaction, over 100 specialised superannuation consulting and technology services consultants have joined Novigi, bolstering its total headcount to nearly 400 people.

6. RSM adds restructuring & insolvency firm Brooke Bird in Melbourne

Professional services firm RSM has boosted its insolvency and restructuring expertise through the addition of Melbourne-based specialists Brooke Bird. Based in the inner-city suburb of Camberwell, Brooke Bird has provided insolvency services to individuals and corporate clients for more than 50 years, with around 70 ongoing engagements to transfer to the books at RSM from the start of the month. Brooke Bird is led by Adrian Hunter (formerly at PPB Advisory and Ferrier Hodgson), who joins RSM as a partner, while the firm’s other partner, Robyn Erskine, crosses to RSM as a senior consultant.

7. IPS joins forces with Sequana and Atlas

Three of Australia’s leading water infrastructure specialists have joined forces in a major industry move set to reshape the delivery of water, environment, and energy projects nationwide. IPS is proud to announce a partnership with Sequana, one of Australia’s fastest-growing strategic advisory and project management consultancies, and Atlas Engineering Group, a technical leader in brownfield water and wastewater programs, to connect the dots across the entire infrastructure lifecycle. This exciting partnership brings together Sequana’s strategic, commercial, and project management expertise, Atlas’s deep technical and engineering capability, and IPS’s hands-on complex infrastructure, construction and delivery experience. The result: a team of around 200 professionals delivering end-to-end infrastructure solutions spanning the entire asset lifecycle, from strategy and planning to design, delivery, and long-term asset management. IPS, founded by Queensland’s current Professional Engineer of the Year, Sascha Kurz, brings to the partnership a team with a strong track record in complex infrastructure delivery while adding specialist construction management, technical engineering acumen, and on-ground experience that strengthens the group’s delivery capacity.

8. Austco Healthcare acquires G&S Technologies

ASX-listed provider of healthcare communication and clinical workflow management solutions Austco Healthcare (Austco) has acquired New Zealand-based systems integrator G&S Technologies. Founded in 2000, G&S Technologies specialises in the installation, service, and maintenance of Nurse Call, Real-Time Location Systems (RTLS), CCTV, Access Control, and other integrated security and communication systems. With over 100 employees, more than 200 customers, and over 5,000 completed projects, the company’s technology solutions also comprise of Distributed Antenna Systems, wifi, networks, GPON, telecom and data systems. The acquisition was completed for an upfront cash payment of NZ$7,966,035 (AU$7,384,195), funded with existing cash reserves.

9. Bluprintx adds Skie to portfolio in ongoing expansion

Bluprintx, the strategic digital transformation consultancy backed by Palatine Private Equity, has acquired Australian Salesforce specialist Skie, in a move that significantly strengthens its global Salesforce capabilities and underlines its ambition to become a leading global consolidator across the Salesforce and Adobe ecosystems. Founded just over six years ago, Skie has rapidly established itself as one of APAC’s fastest-growing Salesforce consultancies, with over 210 certifications and a 50-strong team of experts. The company is known for its creative, high-performance approach to digital transformation, as well as its leadership in implementing Agentforce, Salesforce’s AI platform for autonomous enterprise agents, more widely than any other firm outside of the global systems integrators. The acquisition, completed in February 2025, marks Bluprintx’s latest step in its strategic buy-and-build strategy. It follows a series of international acquisitions, including IO Integration, Definitive Results, and ITG Commerce. The deal was funded by lending partner, ThinCats who have also provided an acquisition facility which will enable Bluprintx to expand its capabilities and reach across key geographies. Skie Co-Founder and Managing Director, Adam Troughear, will join the Bluprintx leadership team, contributing to the development and execution of the company’s global Salesforce strategy.

10. SHIFT4 to acquire Australian payments leader Smartpay

Smartpay sells tailored payment solutions through an extensive distribution network across Australia and New Zealand, supporting a diverse base of more than 40,000 merchants in the region. The acquisition is expected to close in the fourth quarter of 2025, subject to regulatory approvals. Shift4 has successfully executed a similar strategy of combining acquisitions to deliver a superior integrated payment experience with localized distribution, service, and support, valuable merchant-facing products, and owned payment rails to rapidly scale in other regions, most recently in Germany, the UK and Ireland.

11. Riverside acquires mining software solutions company Dingo

Dingo Software, a Queensland-headquartered company focusing on predictive maintenance solutions for the mining industry, has announced that global private investment firm The Riverside Company has acquired a majority stake in the business. Under Riverside’s ownership, Dingo will fast-track investments in AI, while the company continues to operate independently with its current leadership and team. Dingo positions itself as a partner for mining operators seeking to reduce major component failures, improve equipment reliability, boost production and lower maintenance costs. Its software platform Trakka connects to customer’s existing systems and IT infrastructure to collect and analyse all condition monitoring data, identify the root cause of impending issues and deliver the right corrective actions. Dingo’s Trakka Asset Health Manager enables asset-intensive operations to access, understand, and act on an equipment’s condition. The Trakka app is part of a suite of tools designed to help teams manage and maintain equipment health. The app consists of Trakka Insights, enabling users to see equipment health at a glance, recommended actions, and then track progress through resolution, and Trakka Inspect, allowing technicians to perform equipment inspections and condition reporting from the field – all from a mobile device.

12. Stantec acquires Cosgroves, a leading Aotearoa New Zealand buildings engineering firm

Stantec, a global leader in sustainable design and engineering, has acquired Cosgroves, a 90-person buildings engineering firm headquartered in Christchurch, New Zealand. Cosgroves is an industry-leading firm known for technical excellence with public and private sector clients. The addition of Cosgroves will expand Stantec’s buildings engineering capabilities in New Zealand, particularly in fire engineering, electrical, mechanical, hydraulics, buildings sustainability, and civil expertise. The expanded capabilities will support Stantec’s growth in healthcare, advanced manufacturing, and mission critical/data centres—all global business priorities. The acquisition will increase Stantec’s market presence in New Zealand by approximately 10%, to more than 900 staff.

M&A blog Oct: Intense M&A activity in BtoB Services, with IT Services leading the trend

M&A Activity Remains Strong in September Including SCD transaction Libertas/LVP!

18 deals in the month of Aug-25 incl. large ones: CyberCX, Verscent, Nexon, Infomedia

Give us a call on +61 434 730 099. Or, email us at info@scdadvisory.com

or fill in our contact form and we will give you a call.