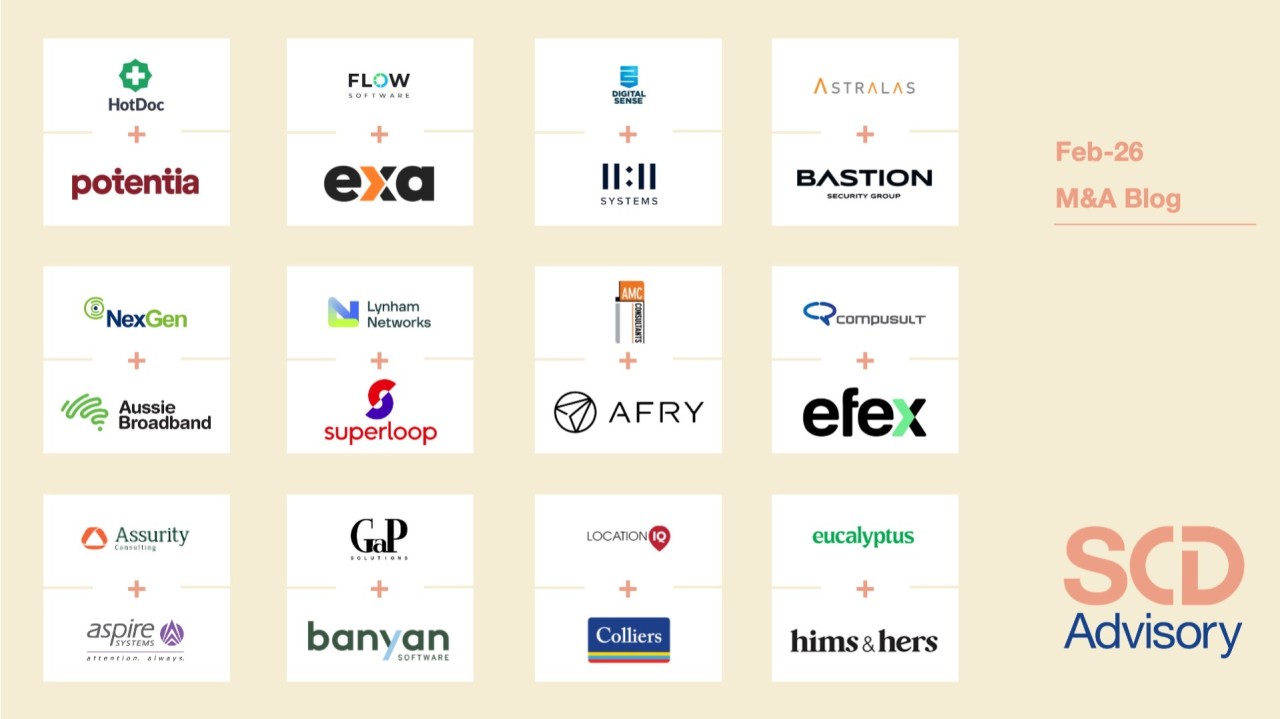

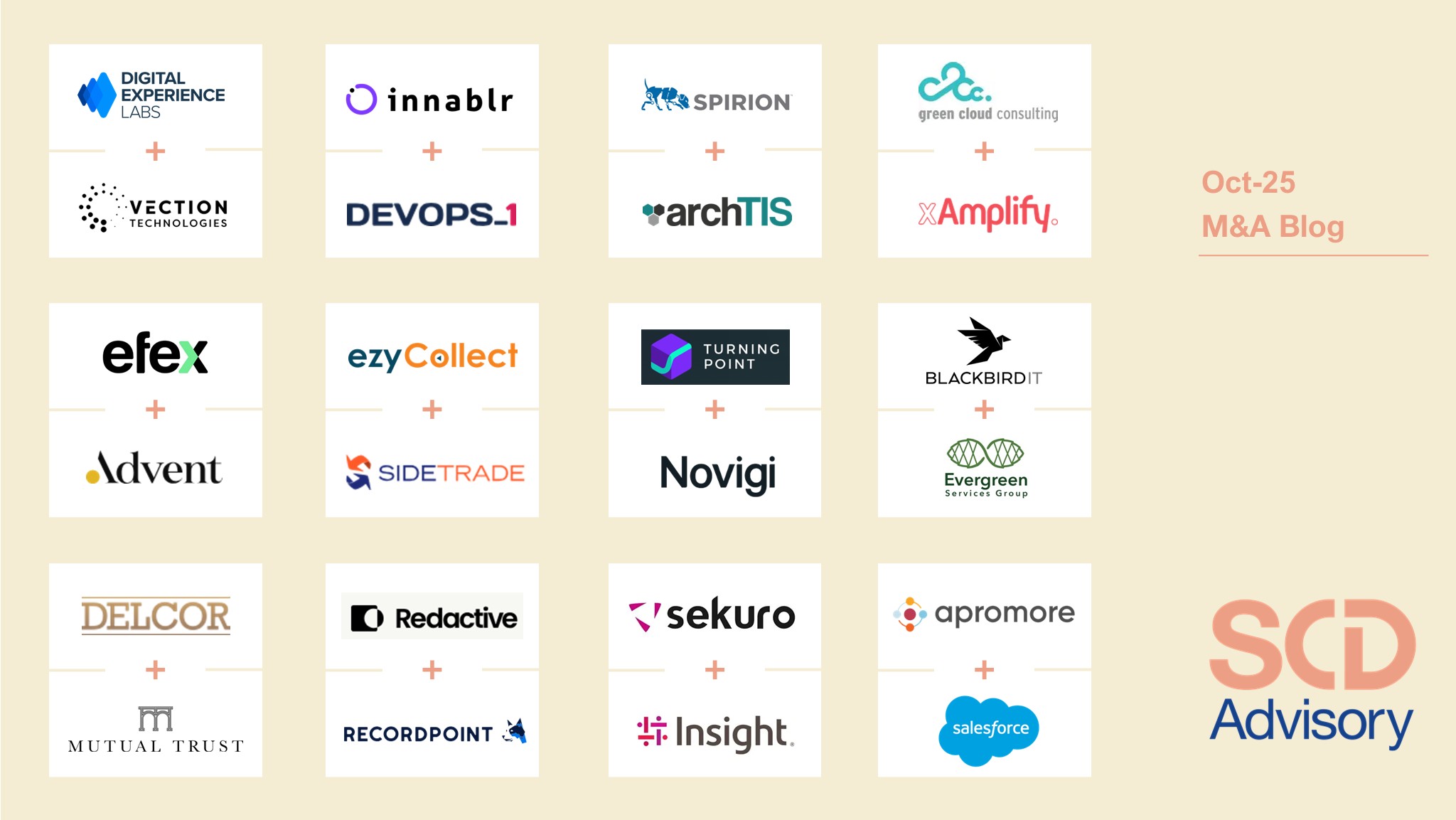

M&A Remains Active in October with key deals across AI, Cybersecurity & IT Advisory

1. Vection Technologies to acquire Digital Experience Labs (DXLabs)

Enterprise-focused AI and extended reality solutions provider Vection Technologies (Vection) has executed a binding offer to acquire 100% of Digital Experience Labs (DXLabs). DXLabs is an Australian digital transformation and solutions business with enterprise customers in government, insurance and adjacent sectors. The company offers tools around process and workflow automation, intelligent rules engine automation and platform integration, positioned as complimentary to a clients existing technology stack and AI technologies. DXLabs reported 39% revenue growth year-on-year for FY25, and the acquisition adds an immediate $3.5 million of revenue and $0.8 million EBIT to Vection with no debt. The transaction is structured as an all-scrip offer with an upfront consideration of $2.1 million (2.8x EBIT) and a performance-based earn-out, aligned to a maximum opportunity of between $0.3-$2.1 million in scrip (for 75%-150% of FY2025 EBITDA performance).

2. DevOps1 snaps up Innablr for cloud, data and platform engineering boost

Australian consultancy DevOps1 has acquired cloud engineering firm Innablr, marking a major step in its strategy to build a scaled local alternative to the global system integrators. The deal combines DevOps1’s enterprise expertise in cloud, security and engineering with Innablr’s decade of cloud, data and platform engineering depth. Innablr’s team of DevOps engineers and architects handle migrating applications to the cloud, building new cloud native platforms, deploying Kubernetes or serverless technologies, aligning with security frameworks and more. DevOps1 founder and CEO Alex Rea said “By combining DevOps1 and Innablr, we’re building a homegrown consultancy with the size, depth and focus to compete head-on with the multinationals. Our customers want an alternative that is close to the market, understands the local context, and can deliver specialist skills at pace.”

3. ArchTIS closes $15.7M acquisition of US-owned Spirion

Data-centric software solutions provider archTIS has completed its $15.7 million acquisition of Spirion LLC, further cementing its path for expansion in the US. The Australian information security provider initially made an offer for the US-based data security posture management (DSPM). ArchTIS signed an asset purchase agreement to acquire the business assets, including the existing customer base, technology, and employees of Spirion. Completing the acquisition on 1 October, ArchTis gains direct access to Spirion’s portfolio of over 150 predominantly North American based customers across various industries, including enterprise customers in healthcare, financial services, government, and education. Spirion’s US-based team of 38 employees, including experienced executives and technologists, have joined the ArchTIS team, significantly expanding its presence in the US and domain expertise in data protection.

4. Xamplify Acquires TechnologyOne specialist Green Cloud Consulting

Macquarie backed xAmplify has acquired Green Cloud Consulting, a specialist in TechnologyOne enterprise resource planning ERP solutions. Green Cloud Consulting’s services cover project implementation and advice; systems optimisation; in-house training and mentoring; system administration; software testing and UAT assistance, tailored reporting, system reviews, and licence reviews. xAmplify’s CEO, Wayne Gowland, said the acquisition serves as another step toward building the capabilities, workforce, and partnerships needed to deliver on the company’s mission to lead in the adoption of innovative digital services across Australia’s governments and enterprises. “By bringing Green Cloud Consulting into the fold, alongside our recent acquisition of CTO Group and investment backing from Macquarie, we’re creating a national platform that can accelerate digital system modernisation at scale,” he said.

5. Advent Acquires Majority stake in Efex, Valuing IT Firm at Up to $200M

Investment firm Advent International has secured a majority stake in the Australian IT managed services company Efex, acquiring it from Alceon Private Equity. This move marks Advent’s entry into a sector known for its stability and growth potential. The deal, reported to value Efex between $100 million and $200 million, reflects significant returns for Alceon, which invested in the company in December 2021 at an enterprise valuation of $54.4 million. Nick Sheehan, who founded Efex in 2013, will remain involved as both a shareholder and the company’s CEO. Efex has experienced rapid growth, expanding its operations across 22 locations in Australia through seven acquisitions since 2021. The company serves approximately 7,500 clients, including small-to-medium enterprises and government entities, with gross turnover reaching $109 million in FY24. Its services encompass IT support, data management, cybersecurity, network monitoring, and procurement solutions.

6. Sidetrade Signs Binding Agreement to acquire ezyCollect

Sidetrade announced that it has signed binding agreements to acquire 100% of Australian fintech ezyCollect, marking its entry into the Asia-Pacific market and furthering its global expansion in AI-powered Order-to-Cash (O2C) solutions. EzyCollect who’s based in Sydney serves over 1,100 small and mid-sized businesses and A$19 billion in receivables. The acquisition, valued at about €37 million, will expand Sidetrade’s reach across three continents, Europe, North America, and Asia-Pacific, positioning the group as a global O2C leader. Founded in 2014, ezyCollect achieved a 28% compound annual growth rate over the past three years and expects 2025 revenues of A$14 million. Sidetrade CEO Olivier Novasque said, “With ezyCollect, Sidetrade has all the assets required to achieve its global ambitions. This proposed acquisition opens immediate access to Asia-Pacific, one of the world’s most dynamic economic regions.” The acquisition, Sidetrade’s largest to date, will result in Asia-Pacific accounting for roughly 13% of group revenue from 2026.

7. Novigi to acquire Turning Point Advisory, Expanding AI Capabilities

The acquisition marks another pivotal step in Novigi’s extensive growth journey, building on a track record of successful acquisitions and strategic expansion. Alex Moynihan and Karan Joshi, drawing on their experience as leaders in Deloitte’s Generative AI practice and backgrounds in technology and AI co-founded Turning Point Advisory to fundamentally transform how organisations deliver and realise value from AI. The firm combines experience in strategy-led transformation with proprietary AI platforms that change and accelerate how organisations prioritise opportunities, rapidly prototype solutions, and scale successful AI-enabled initiatives. Turning Point Advisory has worked with clients across financial services, private equity portfolio companies, and other regulated sectors. “We’re very excited to join Novigi for this next stage of our journey,” said Alex Moynihan, co-founder of Turning Point Advisory. “With the rapid emergence of AI, we are witnessing a fundamental disruption to the professional services business model, and our team is looking forward to combining our expertise with Novigi’s scale and reach, to help clients unlock new possibilities through AI-powered transformation.”

8. Evergreen expands ANZ footprint with acquisition of Adelaide-based BlackBirdIT

Evergreen and its operating company, Lyra Technology, have acquired Adelaide-headquartered managed services provider, Blackbird IT. Founded in 2007 as LeetGeek, Blackbird IT evolved from an Apple integration consultancy to a professional services provider in 2016. Despite years of acquisition interest, the founders of Blackbird IT – Richard Stafford and Ben Corbett, remained steadfast in waiting for an opportunity where values and vision genuinely aligned with their own. Stafford said Evergreens “decentralised model lets our brand, culture, and team remain exactly as they are. It’s the perfect outcome for us.” As a result of the acquisition, Corbett, who has been with the company since 2009, will step into the CEO role. Blackbird IT will continue operating independently under its current brand, joining a portfolio of over 100 independent operating companies whilst benefitting from Lyra’s resources to enhance its service delivery for clients.

9. Mutual Trust acquires DELCOR & LiquidGold Consultants in separate transactions

Australia’s largest multi-family office Mutual Trust, founded more than a century ago by the Baillieu family, is shoring up its operations nationally through acquisitions in Victoria and Queensland, along with promotions internally, one of which aimed at expanding its base in Western Australia. Mutual Trust has acquired Melbourne-based family office services provider DELCOR whose experienced team will enhance its ability to serve Australia’s most successful families with “integrated, purpose-driven solutions”. It also acquired Brisbane-based specialist family enterprise consultancy LiquidGold Consultants, adding to a strengthened presence in South Australia last year through a merger with CMS Private Advisory. The acquisitions are part of a concentrated focus by Mutual Trust to provide Australia-wide support for its clients and aligns with Mutual Trust’s strategy to grow through culturally aligned partnerships. Since 2007, Mutual Trust has grown to oversee more than $16 billion in funds under management with more than 230 employees in four offices nationally.

10. RecordPoint fortifies AI security through acquisition of Redactive

Data management platform RecordPoint has bolstered its capabilities in artificial intelligence security through the acquisition of Redactive, a fast-growing Australian company focused on sensitive data discovery and classification. Founded in 2023, Redactive has raised $19 million since inception backed by the likes of Blackbird, Felicis, Atlassian Ventures and Zapier. In this time, it has pioneered an enterprise-grade AI tool aimed at managing data and secured flagship clients HESTA superfund and PEXA. Anthony Woodward, CEO of RecordPoint, said “With over eight million pieces of data moving through our platform per day, Redactive’s solution will be instrumental as we look to bolster our capabilities with AI security and governance and continue to scale our operations.”

11. Sydney Cybersecurity firm Sekuro bought out by Nasdaq listed Insight Enterprises

Sekuro, an Australian cybersecurity start-up, has been bought out by Nasdaq-listed Insight Enterprises in a deal that comes just two months after its larger rival CyberCX was acquired by Accenture for more than $1 billion. Sekuro was formed in 2021 from the roll-up of four Australian consulting firms. It had targeted an ASX listing but remained private as it built a list of clients including local software giants Canva, Atlassian, and Salesforce. Since 2021, Sekuro has more than doubled in size from a team of 90 to more than 200, and Insight said the deal would help to expand its capabilities in the Asia Pacific. Sekuro posted a net profit of $1.4 million in 2024, according to its financial report lodged with the corporate regulator, down from $1.8 million reported in 2023. Reported revenue rose to $57.9 million, from $51.5 million the year before but chief executive Noel Allnutt told Sekuro’s customer conference in October that this doesn’t paint a full picture as revenue was “hovering around $200 million” and growing at 40 per cent a year. The buyout highlights growing international interest in targeting the specialist cybersecurity firms that work with Australian companies to manage the protection of their digital assets.

12. Salesforce signs definitive agreement to acquire Apromore from Main Capital

Salesforce has signed a definitive agreement to acquire Apromore, a leading provider of AI-driven process mining and process intelligence solutions. The move strengthens Salesforce’s vision for agentic process automation globally. Apromore, founded in Melbourne, Australia, has earned recognition as a Gartner leader for its no-code analytics platform used by organizations across financial services, manufacturing, and government in regions such as Europe, North America and Asia. Under the terms of the deal, Salesforce will acquire the remainder of Apromore’s equity, including the minority stake held by Main Capital Partners. For Salesforce, the acquisition adds a full spectrum of process intelligence capabilities including mapping, task mining, digital twins, root-cause analysis and compliance assurance, directly into its platform. Marcello La Rosa, CEO and co-founder of Apromore, said joining Salesforce accelerates their mission: “We’re thrilled to combine our domain expertise with Salesforce’s reach to empower organizations worldwide with process intelligence. Apromore’s prior integration with Salesforce and SAP systems provides a strong base for seamlessly embedding into Salesforce’s ecosystem.”

Give us a call on +61 434 730 099. Or, email us at info@scdadvisory.com

or fill in our contact form and we will give you a call.